Why open banking is the future for hospitality venues

Unsurprisingly, we’re pretty passionate when we get to speak about how much technology has changed the way we order, pay and more.

But the hospitality industry, once thought of as a sector light on tech use, has undergone radical changes in customer expectations in the past few years.

As in the UK market alone, mobile payments have skyrocketed in popularity – 46% of customers are now comfortable with paying the bill at a restaurant via their phone, and the majority of younger diners would rather pay by QR code than wait for the card reader.

Which means operators have seen a massive increase in customers now willing to use their own devices to pay their tab, pub ordering via the app, check out deals and order directly to the table.

Enter open banking

But at OrderPay, we’re already looking ahead to how digital payments can help operators keep more of their profits, particularly with the current looming energy bill hikes, skyrocketing rent and creeping cost of maintaining quality staff.

So in our recent survey of 2,000 UK adults, we began testing the waters for the arrival of a new disruptive technology set to change the way we pay in venues for good – open banking.

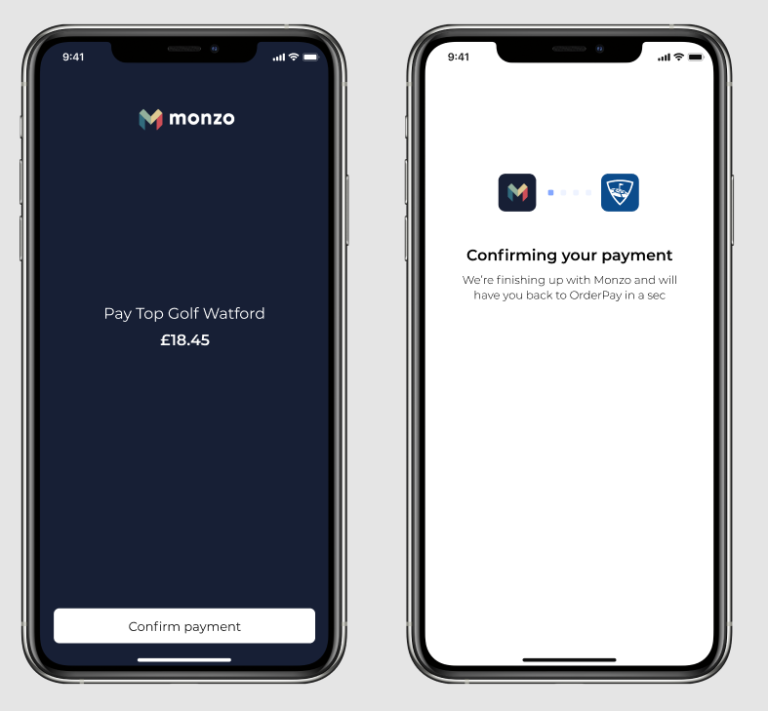

Open banking cuts down the numerous costs involved in taking payments, by allowing third parties to access financial data through the use of application programming interfaces (APIs). This could be revolutionary for venues, as it’s common for operators to believe they’re paying the advertised base rates but be completely unaware of hidden fees, due to the lack of transparency from financial service providers.

Even with modern digital payment methods, monthly profit margins are dented by the costs of maintaining physical terminals, and inundated with murky small print fees that can add an extra 0.36% on top of the headline transaction fee. And that’s before taking in account monthly and ad-hoc costs that don’t appear until you have a chance to check the monthly invoice.

SME’s in particular are worse off, as they are unable to access the favourable base rates offered to larger scale businesses. Creating an uneven playing field when it comes to maintaining a healthy market and a diverse high street. Open banking could be a game changer for businesses looking to bolster their financial resilience and demystify the payment process- both chain and independent alike.

Getting the word out

But if open banking sounds unfamiliar, you’re not alone. Only 37% of the people we asked had even heard of open banking.

As put succinctly by our co-founder Richard Carter:

“The word open next to banking is a little daunting to some, and to be blunt, most people just have no idea what it is.”

There is also the wider issue of 40% of customers not even aware that venues are charged fees when paying by card in the first place. But this might not be the roadblock it first seems, as 83% of people who dine out 4 times a week or more would switch payment methods to save money for a venue.

As it seems even if they don’t understand the full scope of the problem, regulars can be counted on to go the extra mile for their favourite local or chain. Therefore, it’s no surprise that leading voices in the hospitality industry are excited about the potential of open banking:

“The opportunity to embrace the accelerated digital adoption and cut payment terminal fees in half with open banking is very exciting indeed.”

Brandon Stephens, Founder, Tortilla Mexican Grill

Not if, but when

Critically, with the cost of running a business set to rise even further, the arrival of open banking could be a lifeline for the hospitality industry struggling to maintain a healthy bottom line. So we expect to see open banking roll out nationwide in the not-to-distant future, as operators are increasingly nervous about what the upcoming winter bill hike could impact their venues’ footfall.

Putting money back in the pockets of venues could be the lifeline the sector needs, similarly to how order at the table technology kept venues open in 2020 through challenging restrictions seemingly changing by the week.

And with customers open to switching up their payment habits, and more importantly, willing to help out the places they love most – open banking could truly be a step towards a fairer, brighter future for the hospitality industry as a whole.